flow through entity irs

A flow-through entity including a foreign reverse hybrid entity transmitting withholding certificates andor other documentary evidence to claim treaty benefits on behalf of its owners to certify its chapter 4 status if required and to certify that it has provided or will provide a withholding statement as required. See FAQ 17 for links.

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

A flow-through entity is a legal entity where income flows through to investors or owners.

. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Trade or business and dispositions of interests in partnerships engaged in a trade or business within the United States made to a foreign flow-through entity are the owners or beneficiaries of.

This disconnect between receipt of cash and. This means that the flow-through entity is. The payees of payments other than income effectively connected with a US.

Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income. Rules for Flow-Through Entities. A flow-through entity is a foreign partnership other than a WP a foreign simple or grantor trust other than a WT or for any payments for which a reduced rate of withholding under an.

Flow-Through Entity Tax - Ask A Question. As a result only the individuals not the business are. Flow-through entity income is reported by the entitys principals and tax paid on it regardless of whether any cash is distributed.

In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates posted on January 18 2022. Branches for United States Tax Withholding provided by a foreign. The business income tax base refers to the flow-through entitys federal taxable income and any payments and items of income and expense that are attributable to the business activity of the.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. International tax relevance is determined under each part of the new schedules. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following.

A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Flow-Through Entity Tax - Ask A Question. Flow-through entities are considered to be pass-through entities.

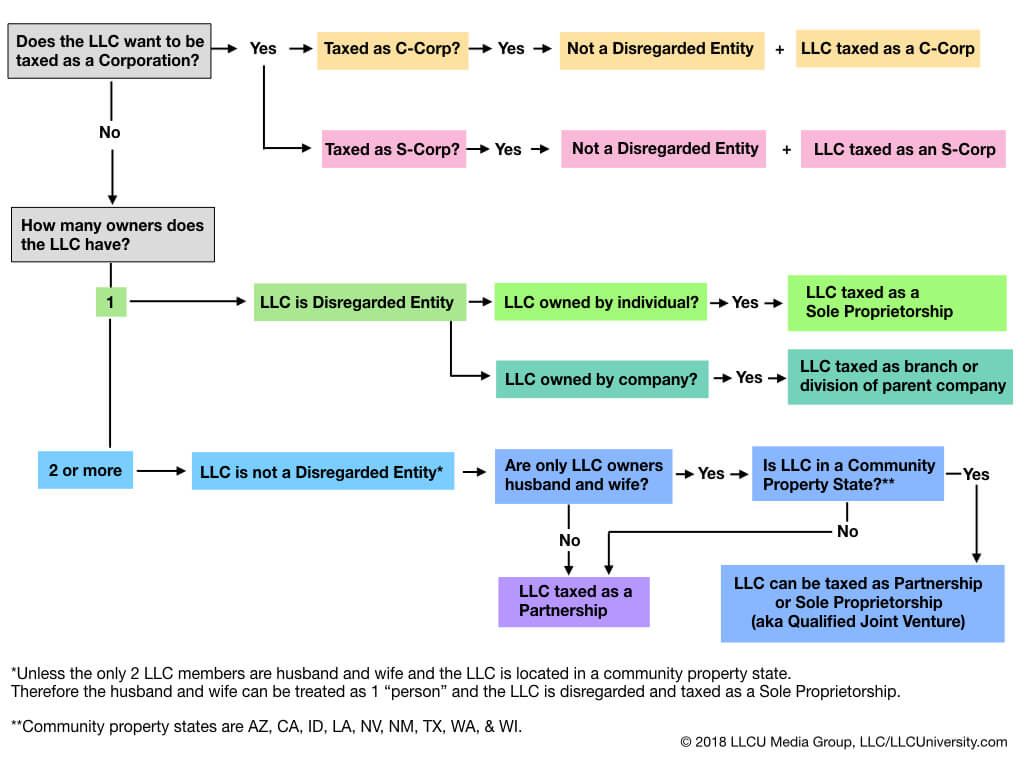

Passive Activity A trade or business in which. The IRS treats sole-proprietorships as disregarded entities which means that the owner reports business income and expenses. That is the income of the entity is treated as the income of the investors or owners.

Understanding What a Flow-Through Entity Is. Sole Proprietorships as Pass-Through Entities. Its gains and losses are allocated or flow through to.

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity. A trust maintained primarily for the benefit of. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

Flow-through entities can generally make the election for tax year 2021 by specifying a payment for the 2021 tax year that includes the combined amount of any unpaid quarterly estimated.

Irs Sweetens Tax Workaround For Nj Pass Through Owners Grassi Advisors Accountants

What Is A Disregarded Entity Llc Llc University

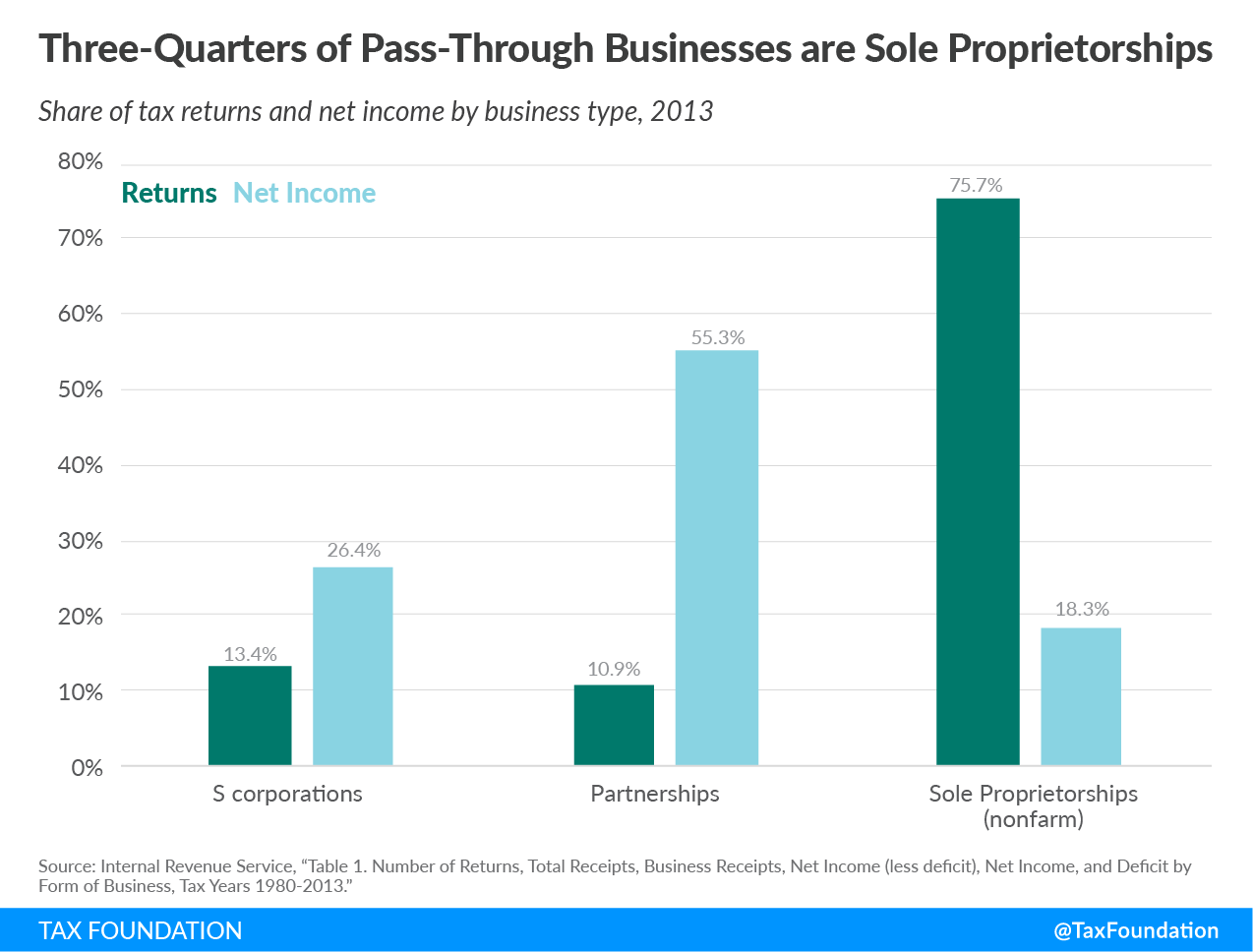

An Overview Of Pass Through Businesses In The United States Tax Foundation

How To File S Corp Taxes Maximize Deductions White Coat Investor

Louisiana Department Of Revenue Updates Partnership Reporting Requirements Cooking With Salt

What Does New York State S Pass Through Entity Tax Mean Foryou Rosenberg Chesnov

Full Disclosure When Tax Transactions Must Be Reported Journal Of Accountancy

Part Ii Irs Form W8 Imy Fatca Driven More On The W 9 And W 8 Alphabet Soup With Fatca Irs Form W8 Imy Tax Expatriation

Oregon Pass Through Entity Elective Tax Kernutt Stokes

How An S Corporation Reduces Fica Self Employment Taxes

What Is A Pass Through Business How Is It Taxed Tax Foundation

New York State Pass Through Entity Tax Sciarabba Walker Co Llp

Flow Through Entity Overview Types Advantages

Pass Through Entity Salt Cap Workaround Lancaster Cpa Firm

4 10 3 Examination Techniques Internal Revenue Service

Do I Qualify For The Qualified Business Income Qbi Deduction Alloy Silverstein

Qbi Deduction Provides Tax Break To Pass Through Entity Owners Cpa Firm Tampa

Form W 8imy Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround